With cash flows declining, margins shrinking, and bad debt on the rise, it’s more important than ever for healthcare providers to maintain a steady stream of income. If your organization has not implemented an end-to-end, comprehensive best practices revenue cycle management (RCM) solution, it is time to do it! You don’t have to add staff; just call on an experienced outsourcing firm with 10+ years of RCM experience with expertise in multi-specialty collections and billing. They will be able to deliver an all-inclusive RCM solution that follows industry-standard key performance metrics to measure success and integrate best practices, so that you get the value of their proven experience and expertise.

Hospital systems are beginning to screen patients in high-deductible plans for their propensity to pay, and many are developing systems to collect in advance of care. The reason is the rise in high-deductible health insurance policies that are challenging hospitals and physicians across the country to change the way they prepare for and collect payments from people who are getting hit with large out-of-pocket costs for care. Hundreds of patients, many of them newly insured, are causing some hospitals to “drown in debt” from these high deductibles not covered by their plans.

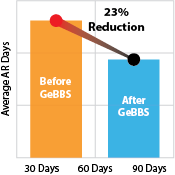

Here are just a few of the best practices an experienced outsourcing company will bring to your RCM and help you identify, at the POS, patients who have the propensity to pay for their services. Collections at the point-of-service are of ever-growing importance. Collecting payment at or before the POS reflects the industry’s experience that as more time passes after care is delivered, a patient’s propensity to pay decreases substantially. By requesting payment before services are rendered — or by making agreed-to- payment arrangements have the potential to substantially reduce uncompensated care and the resultant bad debt.

The revenue cycle starts at registration, so capturing accurate patient information during registration is critical. Documenting accurate patient demographics at the first point of contact lays the groundwork for efficient, effective payment collections.

Conduct thorough eligibility checks. When you overlook potential care coverage during the pre-authorization process, you may be inadvertently leaving revenue on the table, while driving-up potential bad debt and charity care costs. A thorough eligibility and pre-authorization process ensures providers will receive the highest possible reimbursement from a patient’s health plan while reducing a patient’s financial burden.

Shift your focus from Denial Management. A high clean claims rate not only keeps cash flowing, but also it can save thousands of dollars per year in paperwork costs and unnecessary time spent interacting with insurers and reworking claims.

Keep a vigilant eye on your claims metrics. Providers who can spot inefficiencies in their claims processing will have critical insights into their revenue cycle health. They will be able to resolve problems quickly and efficiently by monitoring claims data and establishing benchmarks for claim rejections, denials and the days to final billing.

An experience end-to-end RCM outsourcing firm can offer these best practices and many more than are identified here to help your facility overcome the challenges of declining cash flows, shrinking margins and bad debt.