The Right Solution at The Right Time—Cash Recovery on Neglected Claims Boosts Revenue

I. The Problem of Low-Balance Collection is Universal

After an audit of outstanding accounts receivable (A/R), an extensive healthcare system with over 400 facilities serving 3.5 million patients a year realized there was a big problem with low balances at one of their larger central billing offices:

• 82% of under $2,500 balances were unworked for 90-days or more

• High number of past timely write-offs

• High cost-to-collect with little to no return on investment (ROI)

• Inability to effectively scale operations to manage low balance recovery

Although small balances have a positive impact on revenue and days in A/R, organizations that rely exclusively on their labor pool to resolve claims, often decide that the ROI for efforts needed to recover cash have not proven to be worthwhile. Instead, they most often choose to concentrate their efforts on accounts with higher balances. Many organizations experience the issues of unworked A/R and its consequences. According to the Healthcare Financial Management Association, the top performing hospitals and healthcare systems in 2019 had between 17–26% of A/R aged 90-days and over. Up until recently, the conventional wisdom was to write-off low balance A/R because it was too costly to recover. However, tighter margins and new payment models have dramatically changed the way that many organizations look at uncollected revenue regardless of balance because, in today’s payment environment, every penny counts. The health system could no longer afford to lose revenue and realized the only viable solution would come from outside their organization.

The American Hospital Association estimates that in 2018. hospitals provided $41.3 billion in uncompensated care, up from $38.4 billion in 2017.2 Collecting small balances can no longer be ignored for healthcare systems to remain viable.

II. The Reasons Behind Uncollected Revenue Are Varied

A/R 90-days and older is usually a result of one of these scenarios:

• Lack of staffing and/or capacity

• Unpaid claims

• Lack of secondary billing

• Secondary claim denials

• Missing or inaccurate adjustments

• Self-pay balance transfers

The one thing all situations have in common is that cost-effective labor is needed to resolve theissues. According to recent research published in JAMA:

The combination of labor costs and timely filing requirements constricts efforts to assign and recover revenue from older A/R, especially on low balances. Organizations leave millions of dollars on the table by not pursuing this reimbursement.

III. Time for Action

The hospital system approached GeBBS Healthcare Solutions to help them resolve low balance accounts and capture additional

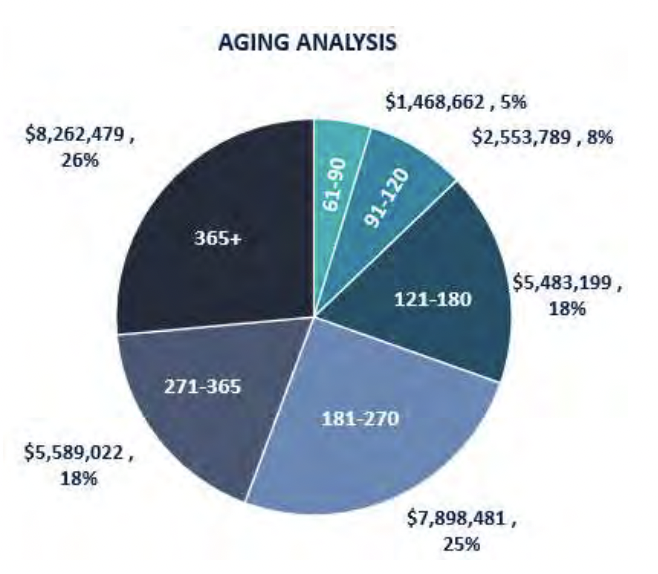

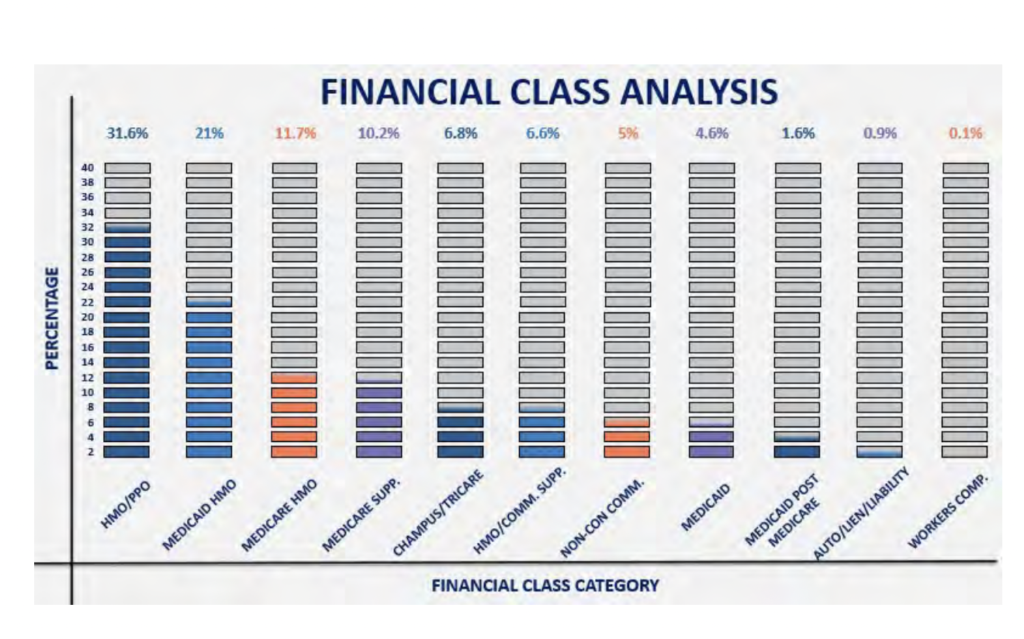

revenue. After further analysis with GeBBS, more details were uncovered. It was revealed that approximately 88% of A/R was aged over 120 days, accounting for a total of $27,233,181 in unresolved balances. Over 50% of these A/R Balances had come from HMO/PPO (32%) and Medicaid HMO (21%). All other financial classes (Medicare supplements, commercial supplements, commercial plans, etc.) were all contributors.

IV. GeBBS Lays the Foundation for Success

One month before go-live, a GeBBS project manager was assigned onsite to understand how the billing department operated and discovered the collection practices on a granular level. According to Kiran Kumar, Executive Vice President at GeBBS, “The first step was to completely immerse ourselves in the billing workflow so we could understand the true scope of the challenge and implement a seamlessly integrated solution. We were not only concentrating on recovering revenue, but we also wanted to solve the problem going forward.” The project manager took a detailed inventory of the A/R and analyzed denial, payer, and provider trends. GeBBS developed SOPs for claims resolution that incorporated existing workflows to minimize disruption and maximize results.

V. iAR™ – The Workflow Solution

“It quickly became apparent that our proprietary iAR™ workflow solution was the best choice for moving forward. It lets us take advantage of advanced skill-based routing, manage inventory and generate detailed reports to implement process improvements quickly,” said Kumar. With so much revenue at stake, and timely filing limits being reached daily, the hospital system decided to outsource the labor to GeBBS. “The healthcare system had used outsourcing in the past, and unfortunately, it did not go well. iAR™ allows us to monitor for quality control closely and gives us the ability to report on progress in real-time, which created a comfort level among the executives, so we got the green light to move forward.”

“The first step was to completely immerse ourselves in the billing workflow so we could understand the true scope of the challenge and implement a seamlessly integrated solution. We were not only concentrating on recovering revenue, but we also wanted to solve the problem going forward.” – Kiran Kumar

VI. The iAR™ Advantage

iAR™ blends seamlessly into existing billing workflows; it combines GeBBS A/R resolution expertise with custom parameters to create focused, results-driven work queues that drives results quickly. This technology does not replace the current system, but rather, is an overlay to the system that provides improved workflow management and detailed analytics.

VII. Efficient and Effective Denial Resolution

Conventional A/R resolution is time-consuming and expensive, which can cause an already overburdened system to write-off otherwise recoverable revenue. In fact, a recent survey bythe Advisory Board found that hospital write-offs of denied claims increased by 90 percent in six years.4

What causes these organizations to abandon rebills and appeals and forgo collecting the money they have rightfully earned? Labor costs are often cited as a leading factor because of the time and complexity required to resolve denials.

Every payer has a distinct way of communicating, making it virtually impossible to use the same denial solution across the board. For example, some payers will accept a CPT procedure code, while others insist on a HCPC – and using the correct CPT will still result in a denial for these cases. Some denial reason codes are deceptively broad, such as “CO-16”, and can contain several remark codes per line item. Experienced denial resolution specialists that routinely work with the same payer learn to identify unique patterns and quickly know which actions to take to expeditiously resolve the claim. This trial-and-error technique is unavoidable and, in most situations, if the experienced specialist moves positions, the knowledge is lost, and the process

begins again.

iAR™ becomes the vault that stores payer data and institutional knowledge. Specialists clear their work queues efficiently and effectively because the information they need is just a click away.

The GeBBS Mission: To partner with clients to help them achieve their strategic business objectives by deploying business-impacting solutions with passion, excellence, and speed of execution.

VIII. The iAR™ Claims Workflow

A/R Management Features Include:

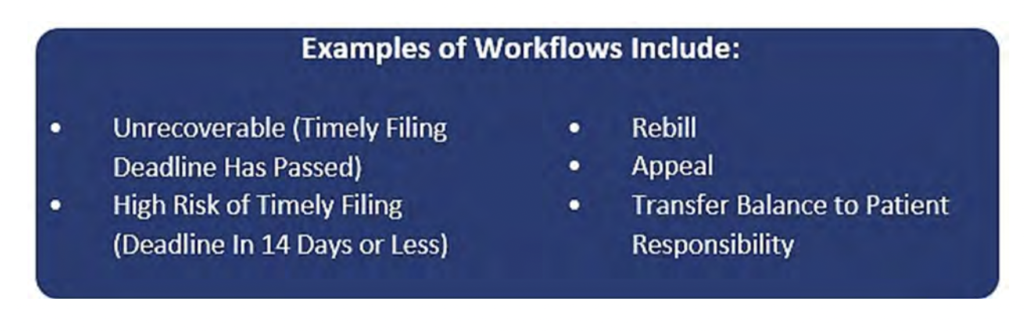

- Automated workflows organize claim work queues to boost productivity

- Comprehensive payer database – stores everything a resolution specialist needs, broken down into specific plan information including phone numbers, claim routing information, and timely filing limits

- Customized, hard-coded SOPs provide easy-to-follow next steps for quick claims resolution

The iAR™ Platform Increases A/R Specialists Productivity By 30% On Average

IX. Customized Strategies Quickly Gain Traction on Hospital A/R

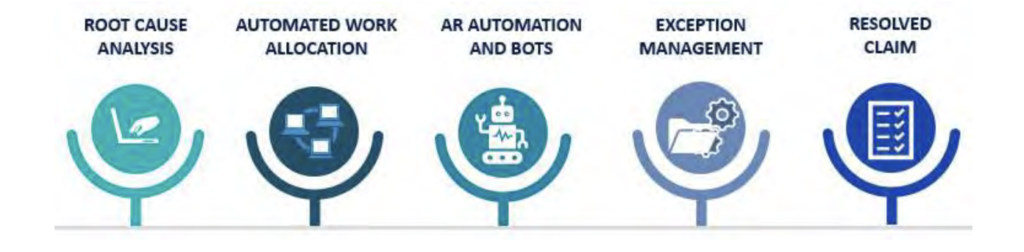

A primary advantage of iAR™ is its ability to use parameters to streamline workflow. Data collected during the initial exploration phase, and analysis of workflow weaknesses, were used to create smart work queues in the iAR™ system. Claims were systematically scrubbed and put into appropriate workflows, which included next action advice.

Highly skilled GeBBS A/R specialists systemically cleared each work queue daily and reconciled back into the healthcare system’s software to ensure up-to-date patient financials. Within the first 60 days, 95% of the assigned inventory was worked. As inventory started to reduce, data and feedback of root cause issues were shared with the hospital at regular intervals to

continuously decrease denials.

X. Burning the Candle at Both Ends

After a deep cleansing of the backlog and significant revenue recovery, GeBBS turned itsattention to working new inventory. In this phase, internal metrics automatically identified and fed any new denials into the iAR™ system for immediate resolution.

From the beginning of the project, GeBBS was invested in the process. GeBBS understood workflows, partnered with directors and managers, and established a proactive communication flow from the outset. When the organization began taking on new inventory, the hospital was able to react quickly to our suggestions for improvement. Together, we effectively collaborated to drive down denial rates and accelerate the revenue.

XI. Regular Meetings with Detailed Reporting Kept All Parties Informed and Accountable

iAR™ has several features that provide superior quality controls and allows GeBBS to deliver daily progress reports and dashboards to all key stakeholders. Daily updates were supplemented by weekly operational and quality collaboration calls between GeBBS and the hospital operations team. The calls confirmed seamless data flow with complete and

comprehensive data capture. “The hospital knew what was going on and was clear about the actions needed to solve issues moving forward,” commented Kumar. “They were surprised by the level of detail we were able to provide.”

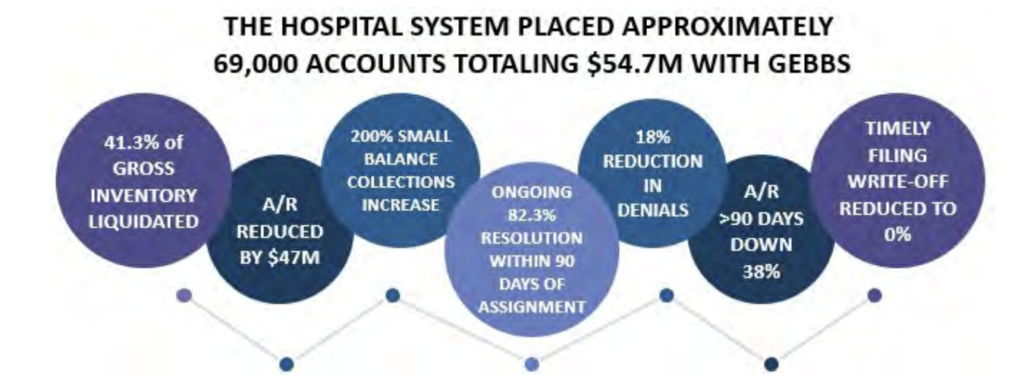

XII. The GeBBS iAR™ Impact: Results

GeBBS found the most significant opportunity to maximize collections was among commercial payers and Medicaid HMO, Medicare Supplement, Medicaid, and CHAMPUS/Tricare had liquidation rates of over 50%. iAR™ functionality and the professionalism of GeBBS’ A/R team were certainly important. But equally as important is the true partnership GeBBS was able to

create with the hospital system. They let GeBBS into all their operations, and that laid the foundation to make the rest possible.

Overall, GeBBS collected 86% of the net A/R

XIII. Conclusion: The GeBBS Advantage

GeBBS Healthcare Solutions is a KLAS rated leading provider of technology-enabled Revenue Cycle Management (RCM) services and solutions in Health Information Management (HIM), Accounts Receivable (AR), and Risk Adjustment outsourcing. GeBBS’ innovative technology, combined with its over 9,500-strong global workforce, helps clients improve financial performance, adhere to compliance, and enhance the patient experience. Headquartered in Los Angeles, CA, GeBBS has won numerous accolades for its medical coding outsourcing and medical billing outsourcing, including being ranked in Modern Healthcare’s Top 20 Largest RCM Firms, Black Book Market Research’s Top 20 RCM Outsourcing Services, and Inc. 5000’s Fastest Growing Private Companies in the U.S.

Is it time to see what GeBBS Healthcare Solutions can do for your organization?

Contact us today at 888-539-4282 to see how we can assist you with your RCM operations or Request a Consultation with one of our solutions experts.

References

- MAP Award. (n.d.). Retrieved April 23, 2020, from https://www.hfma.org/tools/mapinitiative/map-award.html

- Fact Sheet: Uncompensated Hospital Care Cost: AHA. (n.d.). Retrieved April 23, 2020, from

https://www.aha.org/fact-sheets/2020-01-06-fact-sheet-uncompensated-hospital-care-cost - Tseng, P. (2018, February 20). Costs Associated with Physician Billing and Insurance-Related

Activities. Retrieved March 12, 2020, from

https://jamanetwork.com/journals/jama/fullarticle/2673148 - Advisory Board. (2018, June 26). Hospital Revenue Cycles Showing Strength But Risks Include

Denials. Retrieved April 23, 2020, from https://www.prnewswire.com/news-releases/hospitalrevenue-cycles-showing-strength-but-risks-include-denials-300555731.html - The Academy. (n.d.). Quick-Hitting Survey Outsourcing Revenue Cycle Management. Retrieved

April 29, 2020, from https://academynet.com/sites/default/files/quick-hitrevenuecycle_management_0.pdf - Martin, C. (2020, April 27, 2020). Five Components Of An Intelligent Middle Revenue Cycle.

Retrieved April 29, 2020, from https://www.beckershospitalreview.com/healthcareinformation-technology/five-components-of-an-intelligent-middle-revenue-cycle.html