“HFMA calls credit balances the “stealth aircraft of hospital patient accounting.”

I. Credit Balances Are Not Always What They Seem

Credit is a word we hear almost daily, and many people are already familiar with the fact that accounting uses credits and debits to ‘balance the books.’ In the everyday vernacular, we give people credit for a job well done. Credit cards allow us to make purchases. We get checks from companies when there is a credit on our account due to an overpayment to bring it to a zero

balance.

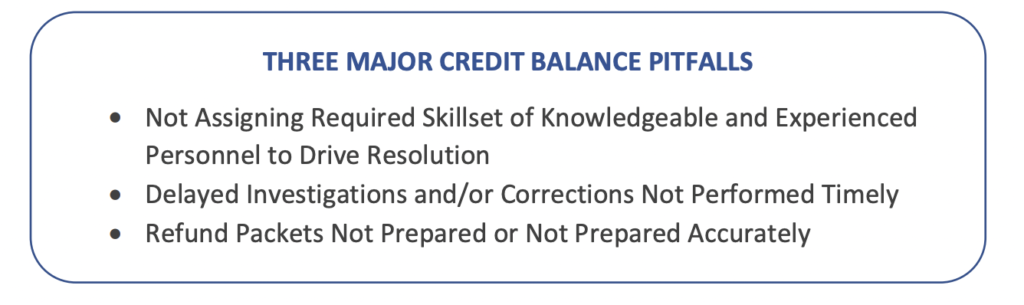

The term credit in the conventional business sense has an uncomplicated action to resolve – you confirm the math and then write a refund check. In healthcare receivables, investigating the validity of credit balances is one of the most challenging exercises the revenue cycle faces. Cash Application professionals need to have critical thinking skills as well as comprehensive knowledge of all components that affect the patient encounter – such as contractual obligations, adjustments, write-offs, coordination of benefits, and insurance take-backs and recoupment posting, to name a few. A simple overpayment is rarely the cause of a credit balance.

Neglecting to manage credit balances can result in heavy fines, bad publicity, and even imprisonment. The news is riddled with headlines about massive settlements related to the False Claims Act and failure to reimburse Government Health Care Programs. Recently a healthcare whistleblower warned management several times of their overpayment obligations to resolve over $175,000 in credits. Ultimately, a suit was filed, and the whistleblower received $90,000 of the $440,000 settlement proceeds.1

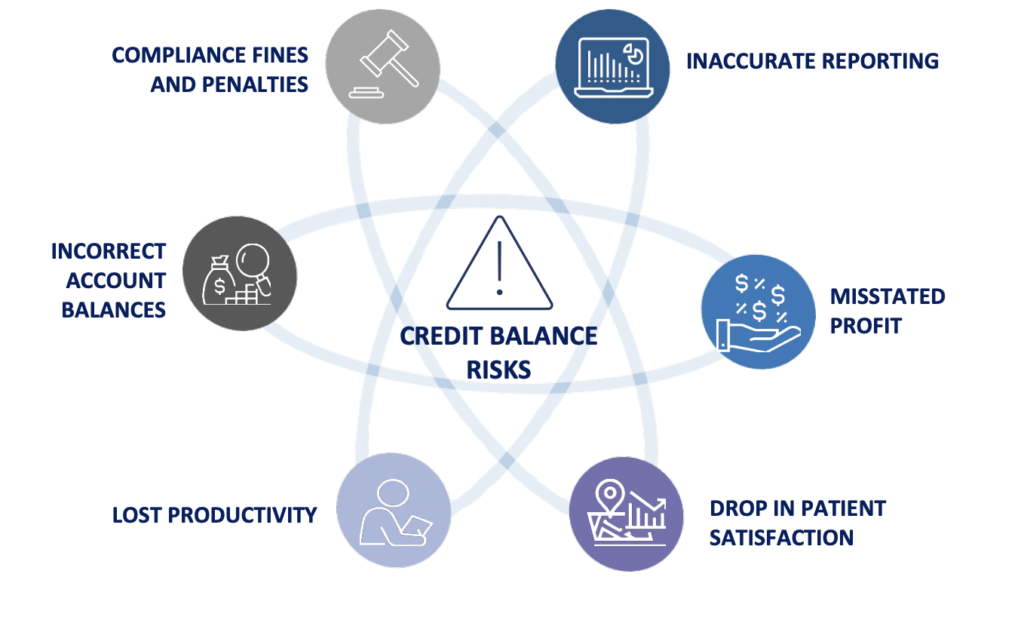

II. The Risks of Credit Balances

As with many processes related to credit balances, there are stringent compliance rules and regulations that must be followed to avoid stiff fines and penalties, including imprisonment.

Some of the most critical are:

• Health organizations are liable for any processes or individuals who conceal, avoid, or try to decrease payments to the

government.2

• Civil penalties run from $5,500 to $11,000 per false claim; damages can be up to three times the penalty amount.2

• Criminal penalties include up to five years imprisonment and $250K per occurrence for individuals, up to $500K for corporations.3

• Penalties for providers that are aware of an overpayment and fail to report or return the payment can be fined up to $10,000 per infraction.4

III. The Compliance Constraints and Implications of Time

In addition to the regulations set forth by laws such as the False Claims Act, CMS published a final rule in 2016 that mandated a 60-day timeframe in which overpayments must be returned.5 The clock begins ticking on the date an overpayment is identified.

An overpayment identification is defined in one of three ways:6

- Knowledge of an actual overpayment

- Deliberate ignorance of an overpayment

- Reckless disregard of an overpayment All three identification scenarios are the result of having information that warrants

investigation and organizations have six months to investigate a credit balance. Any healthcare provider that waits to be contacted by a payer about an overpayment may be committing an illegal act as defined by the Office of Inspector General (OIG).5

Another largely publicized case resulted in a $2.95 Million settlement that stemmed from neglecting to return $800,000 in Medicaid overpayments and failing to fully investigate suspected overpayments.

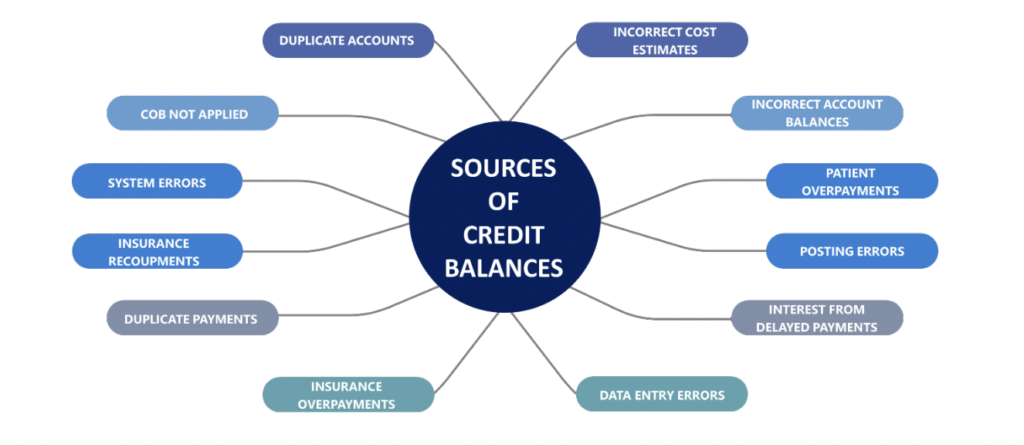

IV. The Varied Sources of Credit Balances

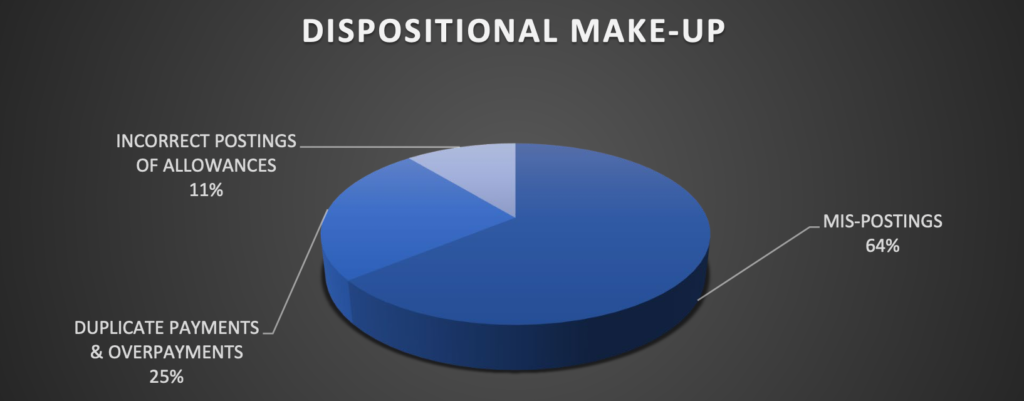

Circumstances that can create a credit balance are found throughout the entire revenue cycle process and can stem from one source or multiple sources. The investigation activities can be rather complicated because each line and activity of the patient encounter must be thoroughly examined and audited to ensure proper resolution.

Perhaps one of the largest misconceptions in accounts receivable is the notion that all you need to do to resolve credit balances is write a check.

Reality is far more complex than such a straightforward solution.

V. GeBBS Resolves Over $32 Million In Credit Balances

The Challenge: A large and prominent hospital was inundated with over $32 Million in credit balances. Executive Leadership was justifiably concerned and overwhelmed with the sheer volume and associated compliance risks of the credit balances. There was also great concern with the distortion and reporting of accurate receivables and ultimately the impact to the bottom line.

The Strategy: GeBBS deployed a credit balance resolution team of experts that comprised of highly trained professionals possessing a hospital accounting background and keen analytical skills. Upon deployment, a robust and detailed root-cause analysis was performed that encompassed in-take and out-put of workflows, adjustment and write-off protocols, payment transfer procedures, adjudication and payment posting processes, refund packet methodologies, and other rules

based activity to form a healthy strategy.

The Solution:

• Assessment of Accounts at Highest Risk

– Government and Compliance Related

– Contractual Obligations

– High Dollar Impact

– Timely Resolution Requirements

• Determination of actual overpayments versus charge entry or accounting errors

• Interpretation and knowledge of payer rules and protocols associated with their specific refund requirements versus take-back or recoupment policies

• Payer outreach to initiate take-back and recoupment actions

• Locating and applying patient funds to other correlating open patient balances

• Correction of erroneous contractual adjustments and other incorrect posting activities

• Changes and updates to the evaluated receipt settlement (ERS) rules engine to capture automated posting errors and prevent false variances

• Utilization of our iCB™ technology to streamline functionality, processes, and workflows

• Preparation and submission of refund packets

• Education and development to assist in preventing future unwarranted credit balances

The solution resulted in the reduction of $32 Million in credit balances to $15 Million in the first 45 days, and a further decrease from $15 Million to $6 Million within 90 days.

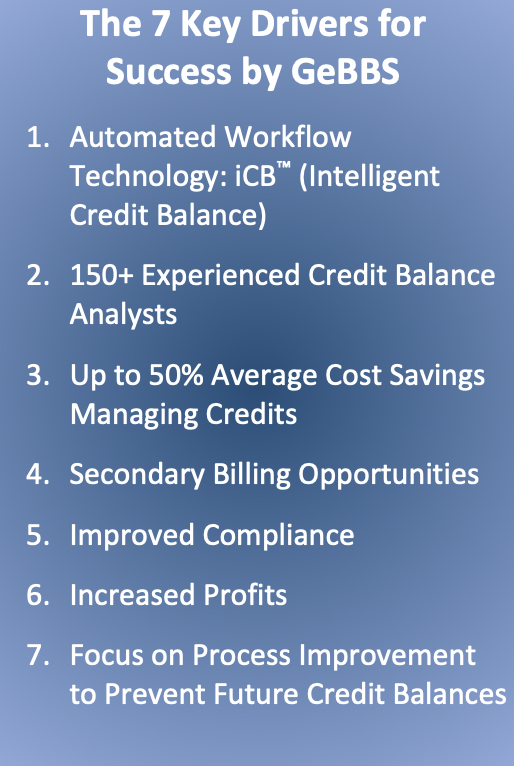

The Success: Critical to the success was not only the flexibility, scalability, and expertise of the GeBBS team, but also our automated iCB™ workflow technology to support fluctuating volumes. The team worked diligently utilizing GeBBS’ proprietary technology to expeditiously and accurately resolve all related issues that contributed to the credit balance conundrum. Client needs were accommodated, and expectations were consistently exceeded, which produced strong working relationships and stellar results. While timely and accurate credit balance identification and reconciliation is essential, preventing future credit balance occurrences is even more vital. A call to corrective action that immediately puts improvements in place is ideal and moreover, whenever a corrective opportunity is discovered, rectifying it at the rootcause level is key.

VI. iCB™ – Intelligent Credit Balance Technology

GeBBS’ proprietary iCB™ (Intelligent Credit Balance) platform is an automated workflow tool that eliminates the redundancies and manual processing of credit balances and posting variances. iCB™ streamlines the research and reconciliation process by automating functional requirements such as tracking and trending credits, root-cause analysis, accurate and timely

resolution, and the creation of refund packets. The platform will efficiently manage current credit balances and will also effectively prevent future credit balances. iCB™ will help decrease operating costs through reduction of allocated staff by half, while more than doubling productivity. It additionally allows for reallocating resources to work more viable revenue generating AR and activities to further increase profits.

VII. The GeBBS Advantage

GeBBS Healthcare Solutions is a KLAS rated leading provider of technology-enabled Revenue Cycle Management (RCM) services and solutions in Health Information Management (HIM), Accounts Receivable (AR), and Risk Adjustment outsourcing. GeBBS’ innovative technology, combined with its over 10,000-strong global workforce, helps clients improve financial performance, adhere to compliance, and enhance the patient experience. Headquartered in Los Angeles, CA, GeBBS has won numerous accolades, for its medical coding outsourcing and medical billing outsourcing including being ranked in Modern Healthcare’s Top 20 Largest RCM Firms, Black Book Market Research’s Top 20 RCM Outsourcing Services, and Inc. 5000’s Fastest

Growing Private Companies in the U.S.

Is it time to see what GeBBS Healthcare Solutions can do for your organization? Contact us today at 888-539-4282 to see how we can assist you with your RCM operations or Request a Consultation with one of our solutions experts.

References

- Jacksonville Cardiovascular Practice Agrees To Pay More Than $440,000 To Resolve False Claims Act Allegations For Failing To Reimburse Government Health Care Programs. (2017, October 13). Retrieved from https://www.justice.gov/usao-mdfl/pr/jacksonville-cardiovascular-practiceagrees-pay-more-440000-resolve-false-claims-act

- Office of Inspector General, D. (n.d.). A Roadmap for New Physicians Fraud & Abuse Laws. Retrieved from https://oig.hhs.gov/compliance/physician-education/01laws.asp

- Burleigh, B., CHBME. (2008, July/August). Do the Right Thing Overpayments are Never Found

Money. Retrieved from https://www.hbma.org/uploads/content_files/Overpayments_JulAug08.pdf - What to Know About new HHS Civil Monetary Penalties: Blogs: Health Care Law Today: Foley &

Lardner LLP. (n.d.). Retrieved from

https://www.foley.com/en/insights/publications/2017/01/what-to-know-about-new-hhs-civilmonetary-penalties - Medicare Program; Reporting and Returning of Overpayments. (2016, February 12). Retrieved

from https://www.federalregister.gov/documents/2016/02/12/2016-02789/medicare-programreporting-and-returning-of-overpayments - Medicare Financial Management Manual. (n.d.). Retrieved from

https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/fin106c03.pdf - Manhattan U.S. Attorney Announces $2.95 Million Settlement With Hospital Group For

Improperly Delaying Repayment Of Medicaid Funds. (2016, August 24). Retrieved from

https://www.justice.gov/usao-sdny/pr/manhattan-us-attorney-announces-295-millionsettlement-hospital-group-improperly