One Platform for All Compliance & Auditing Requirements

I. Coding Audits: The Cornerstone of Compliance & Revenue Integrity

According to the Healthcare Financial Management Association (HFMA), lowering compliance risk and ensuring the accuracy of charges should be top concerns of revenue integrity programs.4

Administrative costs, which are frequently cited as a significant healthcare expense, encompass the ‘business end’ of medicine, such as billing systems, submitting and resolving claims, and office staff labor. A recent survey estimated that administrative costs could be as high as 31% of total healthcare expenditures.1 Back office services, such as coding and denial management, are

a significant percentage of overall administrative costs. When one considers how denial appeals alone cost providers an estimated $8.6 billion to resolve, averaging $118 per claim,2 it is easy to understand the importance of denial avoidance and need for an efficient and effective revenue cycle.

With estimated costs for billing and insurance-related activities running from $20.49 for a primary care visit to as high as $215.10 for an inpatient surgical procedure,5 healthcare organizations need to make the most of every penny of revenue and avoid inefficiencies wherever possible. There is no more effective way of ensuring revenue integrity than frequent, comprehensive audits of claims for overall coding accuracy and missed charges.

According to a recent HFMA survey of 125 healthcare finance executives, 22% identified revenue integrity as the leading

priority for their organizations, but fewer than half (44%) have established revenue integrity programs. Not surprisingly,

many are still tinkering with how revenue integrity fits into their organizations.3

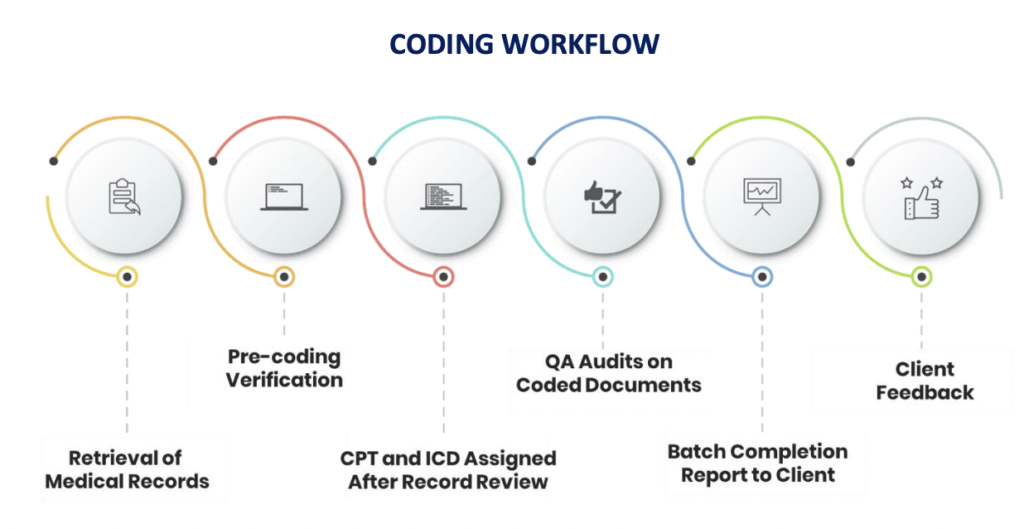

Ensuring correct coding, thereby decreasing denials and their associated costs while increasing accurate payments, is in the best interest of every healthcare stakeholder – but can be challenging to achieve. A typical coding workflow involves a coder that reviews provider documentation and assigns diagnosis and procedure codes. With over 70,000 diagnosis codes and over 10,000 procedure codes, the margin of error is high. The best way to achieve accurate coding and charge capture is to ensure that the documentation is correct and utilize technology that includes analytics and a comprehensive workflow that allows you to capture errors before the bill drops, reviewed by a coder and if needed query the provider to ensure proper documentation. A comprehensive auditing system is the most valuable tool available to keep administrative costs low and maximize reimbursement.

With so much at stake, consistent auditing is necessary to protect your organization’s revenue and mitigate compliance risks.

II. Consistent Code Auditing is Essential

According to the American Health Information Management Association (AHIMA), best practice involves auditing 3.5-5% of total (claim) volume per month.6 The Office of Inspector General (OIG) recommends a minimum of 95% accuracy as a quality standard.7 Without the right tools, coding audits can involve hours of labor analyzing spreadsheets pulled from disparate systems.

Inefficient coding analysis costs an organization more than time – without proper conclusions and corrective actions, organizations risk:

• Increases in denied claims

• Over and underpayment of claims going unnoticed

• Low/high physician compensation due to inaccurate RVU counts

• Revenue claw-backs from RAC audits

• High labor costs due to inefficient workflows

• Missed charges

• Decreased coder education that affects reimbursement

• Delayed revenue from workflow issues concerning discharged, not final billed (DNFB) claims

One study estimates that hospitals are underpaid between 2% and 5% of net patientrevenue.8 A robust auditing program is the best defense against underpayment risk.

III. iCA® in Action: Case Studies

Centralized Coding Oversight and Management Optimizes the Revenue Cycle

One of the nation’s largest hospital management organizations, with acute care hospitals, behavioral health facilities and ambulatory centers, approached GeBBS to help them improve coding across several facilities. The multiple locations presented challenges to coding consistency, with each coding specialty using different rules and coding logic, especially for E/M

services. GeBBS used the data mining capabilities of iCA® to create a quality control process with critical steps such as focus reviews, calibration sessions, exception management, and continuous coding education. Aggregated claims data from all

locations created a single source for auditing and quality control, leading to cleared backlogs and standardized operating procedures for multiple specialties and locations.

iCA Impact

Consistent, on-time coding delivery across patient types with accuracy of >95%

Reduced DNFB by over 80%, from 32 days down to 6 days

GeBBS codes over 60M charts every year and has a coding workforce of over 2000 coders that consistently achieve an accuracy rate of over 95%.

Maximized Revenue with Coding Accuracy and Improved Documentation

A leading provider of healthcare business and operational services that works with 10% of the US healthcare industry, serving approximately 37 million patients, needed an inpatient and outpatient coding audit. The inpatient audit focused on DRGs and physician documentation to maximize revenue. The outpatient review included E/M visits and professional fees for procedures done in hospital settings. Leveraging iCA®’s easy-to-view dashboards and analytics, GeBBS soon gained insight into improvement areas, which included establishing coding continuity and uncovering opportunities to improve documentation. In addition, GeBBS assisted the client with a successful implementation of computer-assisted coding (CAC) on-site.

iCA impact

Consistent, on-time coding delivery across patient types with accuracy of 95%+

Average revenue per month increase 187%, from $226K to $600K

Quality Management Expertise Leads to Accurate Retrospective Audits and Workflow

An east coast-based client approached GeBBS for retrospective audits because they had been experiencing lower reimbursement rates, due in part to a high percentage of denials. iCA® provided a comprehensive review of coded reports and identified gaps in coding that were costing the client revenue. The platform focused on CPT errors, missed flat fee codes, and missed PQRS opportunities. The GeBBS team partnered with the client to create and implement an integrated quality management system, including standard operating procedures (SOPs), that raised revenue and significantly reduced denials. Within the first two months, overall collections increased by 25%.

iCA impact

Productivity improved by 13%

Expected levels of performance improved to >=98%

45% charge volume growth

Claims backlog cleared quickly, with no impact on daily deliverables

Hospitals deciding to use a specialized partner to process complex claims climbed almost 20% in one year. The majority (77%) saw increases in productivity and efficiency within their internal RCM.3

Coding Documentation and Validation Review Increase Reimbursement and Decrease Rebills

A southeast based healthcare system approached GeBBS because their HIM team was understaffed, and there was a lack of coding accuracy and productivity among their existing vendors. The iCA® baseline audit revealed system weaknesses, opportunities to improve coding accuracy, and workforce limitations. From the initial audit arose a more focused DRG review, which uncovered inconsistencies and trends requiring attention. The GeBBS team tailored education for coders and providers, as well as provided staffing support for coding activities.

iCA impact

Overall coding accuracy improved to >95%

Over $350K of missed revenue captured

Reimbursement increased by 5%

Rebills reduced by 9%

IV. Protect Your Revenue and Stay Compliant with iCode Assurance®

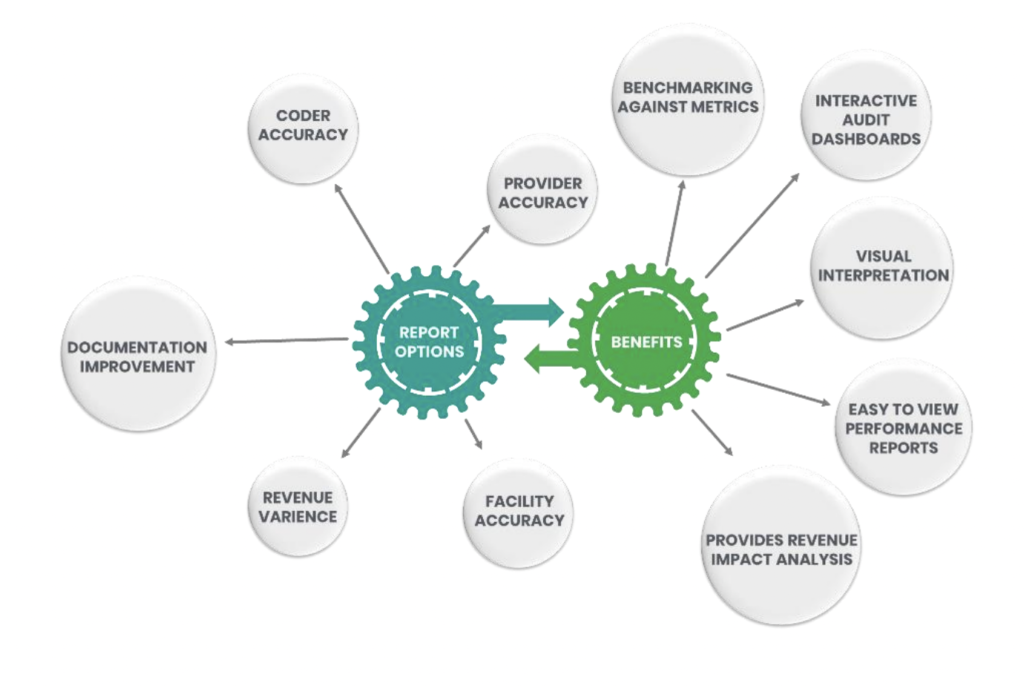

GeBBS’ iCode Assurance® (iCA®) is a cloud based, customizable coding audit software (SaaS) that works in conjunction with your EHR and coding platforms. With proprietary analytics builtin concurrent and retrospective workflow, interactive audit management dashboards, detailed scorecards, and robust reporting, it optimizes and accelerates the coding audit process.

It improves overall coding quality and compliance for hospitals and providers while providing the ability to access audited and scored records for education, review, and process improvements to achieve your revenue goals.

V. The iCA® Difference

Combined Technology for All Workflows

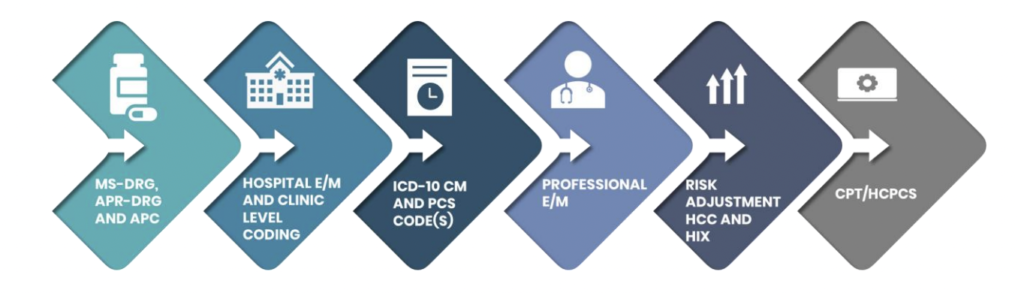

iCA® allows clients to streamline workflows for concurrent reviews and retrospective audit workflows for facility inpatient and outpatient, professional fee coding, and Hierarchical Condition Category (HCC) audits.

Workflow Optimization

All coding workflows can be monitored, reported, and trended in iCA®. iCA®’s proprietary workflow automation increases productivity, reduces redundancies, and improves coder and auditor accuracy while expanding overall volume capacity.

Education and Training

Not only does iCA® improve coder accuracy, but it also improves clinical documentation through the query process. Integrated processes such as provider queries, real-time HCC status, and rebuttal delivery streamlines coding and auditing while improving communication.

Implementation of iCA reduces IT resource time managing disparate systems by at least 20%

Average review time per record decreases 40% with iCA

Turn-around time for coder rebuttal decreases by 200%. All communication is within the platform – no more emails!

Revenue Capture and Loss Prevention

iCA® helps organizations achieve overall targets and goals, including mitigation of DNFB, decreased denials, increased collections, and expedited cash flow. It protects revenue by identifying compliance risks and identifying undercharging practices.

VI. Auditing and Compliance Services

GeBBS: Your External Compliance Partner

The power behind GeBBS’ success for their clients is the combination of iCA® technology and thousands of trained, certified professionals that provide coding and education support where and when it is needed. Secure, cloud-based iCA® dashboards and analytics are available for review 24/7. You can be confident in the knowledge that you have the most up-to-date information available because iCA® works in conjunction with your EHR and coding software. All your coding activities, wherever they are performed, are aggregated together. A single login provides you with the customized reporting and analytics you need to gauge coding performance to ensure optimized productivity, coding accuracy, and maximized revenue.

Using its proprietary iCA® technology, GeBBS can customize external audits to fit your needs; we offer a complete suite of coding and documentation reviews to support your organization.

VII. The GeBBS Advantage

GeBBS Healthcare Solutions is a KLAS-rated leading provider of technology-enabled Revenue Cycle Management (RCM) services and solutions in Health Information Management (HIM), Accounts Receivable (A/R) and Risk Adjustment outsourcing. GeBBS’

innovative technology, combined with its over 9,500-strong global workforce, helps clients improve financial performance, adhere to compliance, and enhance the patient experience.

The GeBBS Difference

Coding and Audits All in One Platform

Coding Support Available 7 Days A Week

~900 AHIMA and/or AAPC Certified Coders

95% Overall Coding Accuracy

Headquartered in Los Angeles, CA, GeBBS has won numerous accolades for its medical coding and medical billing outsourcing, including being ranked in Modern Healthcare’s Top 20 Largest RCM Firms, Black Book Market Research’s Top 20 RCM Outsourcing Services, and Inc. 5000’s Fastest Growing Private Companies in the US.

Iis it time to see what GeBBS Healthcare Solutions can do for your organisation?

Contact us today at 888-539-4282 to see how we can assist you with your RCM operations or Request a Consultation with one of our solutions experts.

References

- Tseng, P., Kaplan, R., Richman, B., Shah, M., & Schulman, K. (2018, February 20). Administrative Costs Associated with Physician Billing and Insurance-Related Activities at an Academic Health Care System. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5839285/

- An Estimated $262 Billion in Healthcare Claims Initially Denied in 2016. (2017, June 26). Retrieved from https://www.businesswire.com/news/home/20170626005391/en/ChangeHealthcare-Analysis-Estimated-262-Billion-Healthcare

- Murphy, B. (n.d.). How hospitals can protect the bottom line, increase efficiency. Retrieved from https://www.beckershospitalreview.com/finance/how-hospitals-can-protect-the-bottomline-increase-efficiency-by-outsourcing-key-revenue-cycle-functions.html

- Emmel Golden, M., Swindle, J., & Kim Felix, R. (n.d.). Defining revenue integrity KPIs. Retrieved from https://www.hfma.org/topics/revenue-cycle/article/defining-revenue-integrity-kpis.html

- Phillip Tseng, M. (2018, February 20). Costs Associated with Physician Billing and InsuranceRelated Activities. Retrieved from https://jamanetwork.com/journals/jama/articleabstract/2673148?redirect=true

- How to Choose the Right Coding Audit Method. (n.d.). Retrieved from

https://bok.ahima.org/doc?oid=302442 - Federal Register / Vol. 65, No. 194 / Thursday, October 5, 2000 / Notices. (n.d.). Retrieved from

https://oig.hhs.gov/authorities/docs/physician.pdf - Emmel Golden, M., Swindle, J., & Kim Felix, R. (n.d.). Defining revenue integrity KPIs. Retrieved from https://www.hfma.org/topics/revenue-cycle/article/defining-revenue-integrity-kpis.html